If you are already seeing a specialist for your condition, make sure your doctor is in your plan's network. If the doctor is not in your plan's network, you will pay more in most cases. Also make sure your specialist uses providers and facilities in your plan's network when sending you for other services or hospitalization. If you have any questions, call us at the customer service number listed on your member ID card.

If you are looking for a doctor for your chronic condition, you can use theProvider Finder tool. Click on "Network Type" at the top and select the name of your HMO plan to see a list of doctors and hospitals in your plan's network. Unlike commercial insurance and Medicare, too few physicians and other health care providers in New Jersey accept Medicaid. For primary care, including general pediatrics, the state's Medicaid program pays providers about half the rate that Medicare pays.

The policy of paying half the rate — for the same service — is inequitable and unacceptable. If you receive health insurance from your employer, speak with your benefits manager. Ask about the potential of alternative health plans that maintain in-network access to Memorial Hermann facilities and providers. If you have questions about the services rendered, you should contact the health care provider. If you have questions, please contact Member Service at the number on the front of your ID card. Group health insurance and health benefit plans are insured or administered by CHLIC, Connecticut General Life Insurance Company , or their affiliates .

The Cigna name, logo, and other Cigna marks are owned by Cigna Intellectual Property, Inc. When you receive a bill from your doctor, it is often for your copayment, co-insurance, or deductible. These are features of health plans, and basically have the member share in some of the cost of their health care.

For example, some health plans require that the member pay $10 for an office visit and the rest is covered by the plan. Each covered member of your family may choose his or her own primary care provider , and choosing the right one is important. There are many different types of PCPs, including general practitioners, internists, pediatricians, family medicine physicians, and nurse practitioners. To choose the best fit for you or your family member, begin by asking for recommendations from the people you trust. You should also consider each PCP's distance and accessibility from your work or home.

Most importantly, talk with us to be sure that the practice can meet your personal health care needs. For non-emergencies, some HMO plans allow you to get health care services from a Blue Cross and Blue Shield-affiliated doctor or hospital when you are traveling outside of Illinois. If you aren't sure, contact customer service at the number listed on your member ID card before you go. And always remember to carry your current BCBSIL member ID card. It contains helpful information for accessing health care at home or away.

If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card. If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician. Because your PCP coordinates your care, you should always let our group know whenever you seek treatment of any kind.

For further details about the specific cases that don't require a referral, please call Member Service at the number on the front of your ID card. When you and your primary care provider determine that you need specialized care, your PCP will "refer" you to a specialized provider from our trusted team. A referral is required by your HMO health plan before the plan will cover certain services. If your plan doesn't require that you choose a PCP, you can see a specialist or other health care provider without a referral. However, you'll still need to see a provider who participates with Blue Cross Blue Shield of Massachusetts in order to have your benefits covered at the highest level.

Also, HMOs generally only cover health care services provided by a network of health professionals and hospitals that together provide a full range of health care services. When choosing your new plan, make sure the doctors and hospitals you want to use are all in the HMO's network. Establishing a foundation of primary care, with access for everyone in our state, is essential to creating a healthy population. If your selected participating dentist determines that you need specialty care, you have access to a network of specialty care providers. Most plans are direct referral plans, which means your selected participating dentist will provide you with the name of a network specialist. Hospital administrators say this coordinated network of providers streamlines care and produces better outcomes for the money — known in the industry as value-based care.

In 2006, Blue Shield agreed to a $6.5 million settlement relating to allegedly modifying the risk tier structure of its individual and family health care plans. In 2008, the organization settled for $3 million with the California Department of Managed Health Care to resolve allegations of improper rescission of individual health plan coverage. Further, the organization reinstated coverage to 450 members whose plans had been canceled and agreed to provide compensation for any medical debts incurred by these policyholders due to the rescission.

Based on our research, we rate MISSING CONTEXT the claim that Blue Cross Blue Shield pays doctors bonuses based on the number of patients vaccinated. Providers receive bonuses for overall performance and service, which can include vaccinations. But vaccines are not the only determining factor for payments, and experts say the programs are aimed at promoting the quality of care, not volume.

The poster making this claim provided no evidence supporting it, and USA TODAY found no evidence of a program offering those specific payments. It was developed by doctors and pharmacists after careful evaluation of clinical studies to determine which medications are most effective, safe, and maximize cost savings. Most plans, like ours, also maintain a small list of non-preferred drugs.

The vast majority of the non-preferred drugs have one or more FDA-approved, covered alternatives. Our formulary allows us to offer you brand-name and generic drugs that meet your needs at a reasonable cost. Your primary care provider is the most important part of your health care team. With a comprehensive understanding of your medical history and conditions, your PCP will be your partner in everyday, preventive care, as well as the coordinator of any specialized care you may need. We believe collaborative relationships between you and our team of trusted, skilled doctors provide you with the best possible care.

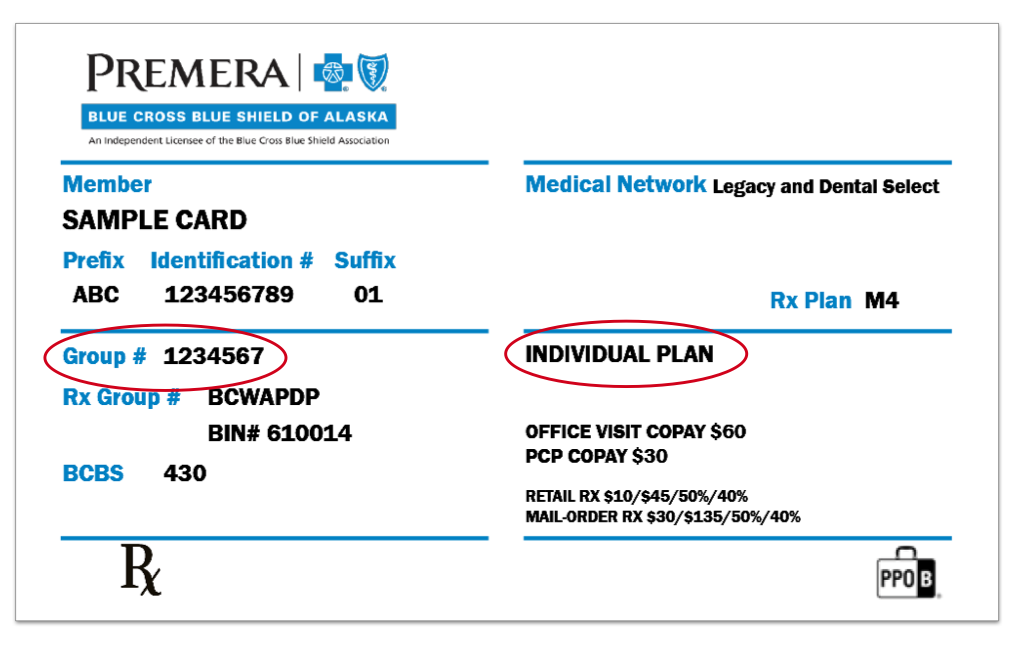

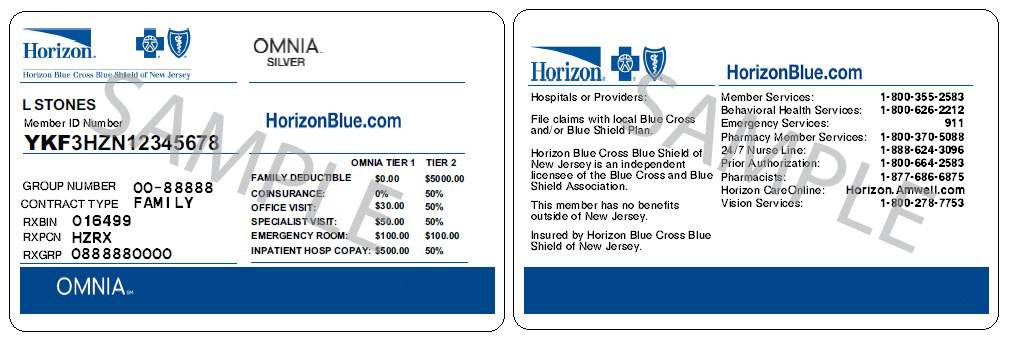

Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy. Keeping your card in a secure location will also help protect you from medical identity theft. This communication provides a general description of certain identified insurance or non-insurance benefits provided under one or more of our health benefit plans. Our health benefit plans have exclusions and limitations and terms under which the coverage may be continued in force or discontinued.

For costs and complete details of the coverage, refer to the plan document or call or write Humana, or your Humana insurance agent or broker. In the event of any disagreement between this communication and the plan document, the plan document will control. If you have a managed care plan (like HMO Blue or Blue Choice®), your primary care provider provides or arranges for most of the care you need.

If you require the care of a specialist, in most cases you must obtain a referral from your PCP to receive coverage. We offer three levels of qualified health plans that all provide essential health benefits coverage. Offering health insurance for individuals, families, employers and Medicare, our health plans give you coverage that's focused on your health and well-being. We are here to help answer your questions and find the plan that fits your needs.

Employers can choose from a variety of medical, pharmacy, dental, vision, life, and disability plans. While costs can vary depending on your benefit plan, you usually pay less for generic drugs and more for brand name drugs. Your plan may cover some of the costs of drugs not on your preferred drug list. You can learn more by looking in your benefit book, or calling the customer service number listed on your member ID card. Your first premium payment activates your coverage, so you can start using your health plan within 1–2 days of making your payment, depending on how you pay.

After you've made your first payment and your coverage is activated, you can have health care expenses during that coverage gap applied to your deductible, or even get paid back for some services. In this case, the coverage gap would be the time between your requested effective date and the date you make your first payment. Blue Cross Blue Shield members have access to medical assistance services, doctors and hospitals in most countries around the world. To learn more about your international coverage visit BCBS Global® Core or contact your local BCBS company. It also contributes to racial disparities in health care access, quality, and outcomes. Medicaid serves a racially diverse population, with 66.6% of non-elderly Medicaid enrollees identifying as Black, Latino, Asian, or mixed race.

Underpaying for health care that covers more racial minorities is not equitable — and leads to less access, fewer choices, less culturally aligned care, and lower quality. It drives people to the emergency department for primary care, the most expensive, and often the worst, place for primary care. Schneiderman's argument against this bill is that costs will increase if the enrollment period is flexible because people will only enroll when they need the insurance. She defends the added cost as needed to level the playing field for the insurance company. The independent physicians are part of Memorial Hermann's Accountable Care Organization, or ACO, which brings together hospitals, doctors and other providers to coordinate and improve care. Under the ACO, Memorial Hermann negotiates rates for the physicians, and in exchange, the independent physicians share data with the hospital.

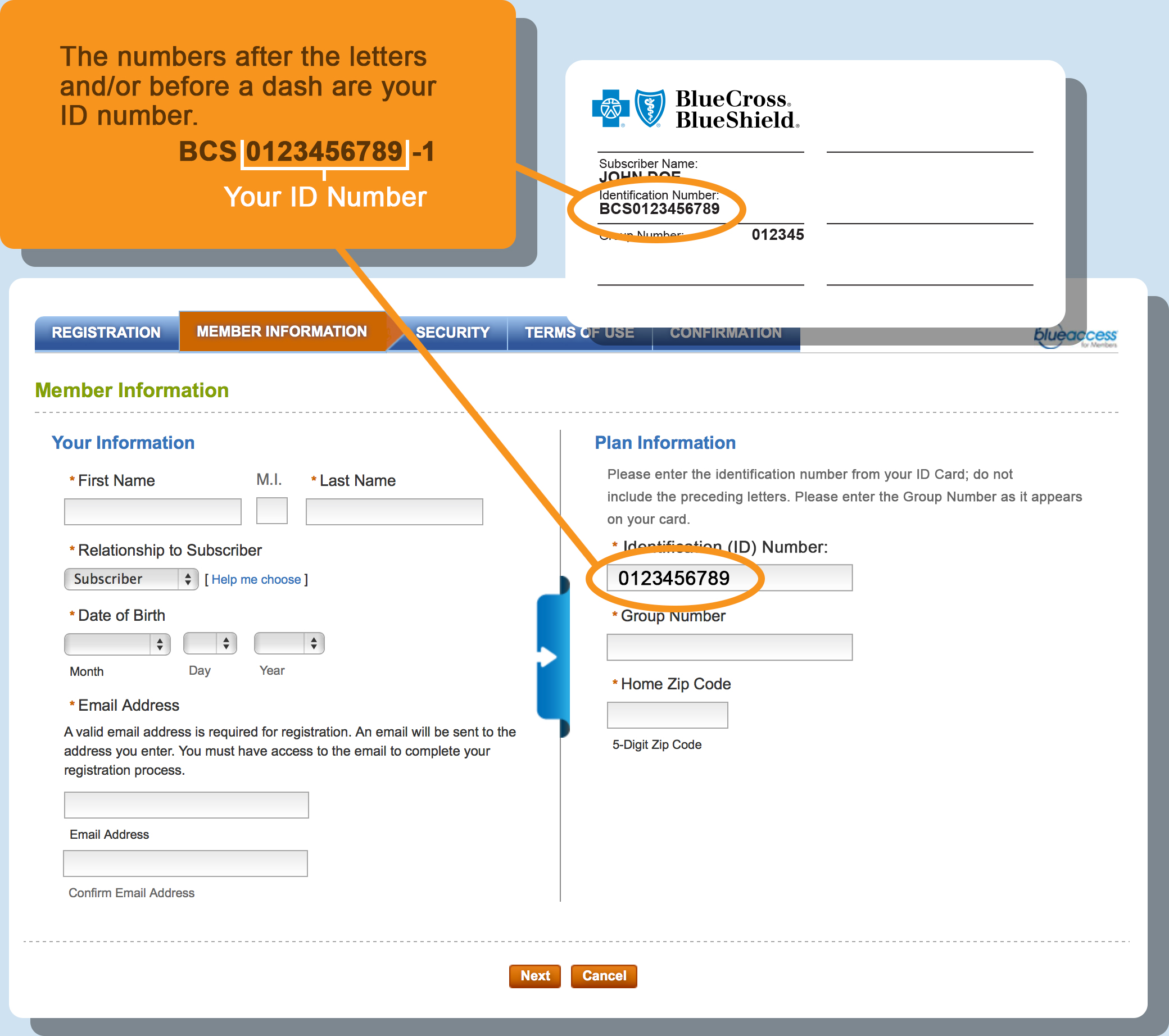

Where To Find Insurance Group Number In 2012, physicians in Alabama were able to receive bonuses for completing breast cancer screening, cholesterol screening, adult BMI assessments and more, peran incentive manual. If you are enrolled in Medicare Advantage, you may be eligible to switch health plans through March 31, 2022. Contact your broker, consult with a trusted family member, or visit this websiteto review available plan options inclusive of access to Memorial Hermann. Call BCBSTX through the Member Services phone number on the back of your plan ID card. Let them know that it is important you maintain in-network access to Memorial Hermann's network of providers and facilities to ensure you have options when it comes to your healthcare.

Your online account is a powerful tool for managing every aspect of your health insurance plan. Whether you need to check on a claim, pay a bill, or talk to a representative, you can easily access all your member features. Your ID card says, "I am a Blue Cross NC member." You must show it every time you visit an emergency room, urgent care center or health care provider. It's your identification that says, "I am a Blue Cross NC member." The back of your card has several important phone numbers to use when you need help.

You'll need to show it every time you visit an emergency room, urgent care center or health care provider. We'll work with you to provide coverage for the most appropriate care for your medical situation, especially if you are pregnant or receiving treatment for a serious illness. You may still be able to see your current provider for a brief time. Call us at the customer service number listed on your BCBSIL member ID card for more information.

Your member ID number identifies you as a covered member of Blue Cross and Blue Shield of New Mexico. It's very important because it is how you access your benefits when you need care, much like a credit card lets you use your account to make purchases. Your member ID number connects you to your information in our systems, and is what providers use to make sure you are covered for a treatment or medicine when you seek care. Blue Cross Blue Shield offers enhanced coverage and service through its broader portfolio of international health insurance products to meet the unique needs of globally mobile individuals and businesses worldwide.

International healthcare coverage is available for employers, individuals and students, providing peace of mind for everyone from short-term travelers to long-term expatriates, for destinations around the world. Forty-five percent of all beneficiaries—or 28 million individuals—are now enrolled in Medicare Advantage plans. Enrollment in special needs plans is driving the growth, with SNP membership growing 20% year-over-year to 4.5 million enrollees, representing 16% of all Medicare Advantage lives. National health plans are the largest investors in this space, Herro said. We need a permanent commitment to equitably fund primary care as the foundation of our Medicaid program. Otherwise, New Jersey will continue to perpetuate a structurally inequitable health care system where people enrolled in Medicaid, more of whom identify as minorities, have less access to high quality care.

The MetLife Exclusive Provider Organization contains features similar to PDP & DHMO. You must see an in-network EPO provider to utilize dental benefits. That argument might make sense for health insurance products other than those that apply to Medicare beneficiaries, but it is flawed in many respects for the elderly. I have been counseling people about insurance issues for years and many don't understand why they need a Medicare supplemental policy so, when they finally figure it out, their initial six month enrollment period is over.

When they look at the cost of a policy they then realize they can't afford it. If a person has Medicare Parts A and B they need a supplemental policy to cover the 20% of costs not covered by those plans. They can buy a Medigap policy or enroll in a Medicare Advantage plan.

Medicare Advantage is a Trojan horse because it lures people in with low or no premiums and coverage comparable to a Medicare supplemental plan at no additional cost. If that person uses their insurance they could have to pay $6000 or more out of pocket that they would not have to pay under traditional Medicare. "Government and commercial health plans have advocated and implemented reimbursement reforms that shift from volume to quality," Chen said via email, pointing to programs such as the Comprehensive Primary Care Initiative. The Applied Behavior Analysis Medical Necessity Guide helps determine appropriate levels and types of care for patients in need of evaluation and treatment for behavioral health conditions. The ABA Medical Necessity Guide does not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members.

Members should discuss any matters related to their coverage or condition with their treating provider. Health benefits and health insurance plans contain exclusions and limitations. As a result of Massachusetts health care law, most Massachusetts residents age 18 and older are required to have health insurance. If you have additional questions, please call Member Service at the number on the front of your ID card.

Be sure to have your ID number, health care provider's name, and the date of service handy when you call. All HMO Blue® and HMO Blue New EnglandSM members must get a PCP referral before seeing a specialist. Because your PCP knows your history and health care needs, he or she is best qualified to help you decide whether a specialist is needed. Blue Choice® and Blue Choice New EnglandSM members have the option to self-refer for covered services at a higher out-of-pocket cost.

Blue Cross Blue Shield of Massachusetts relies on physicians practicing in Massachusetts to provide feedback on pharmacy program decisions. This committee, made up of representatives of physician organizations in Massachusetts, reviews drug comparisons for clinical benefit, side effects, and relative cost. The principle mission of the committee is to ensure that our members have drugs covered, or made available on an exception basis, that meet their needs and achieve desired treatment goals. On an ongoing basis our Pharmacy & Therapeutics Committee reviews the safety, effectiveness, and overall value of new drugs approved by the FDA. While a new drug is being reviewed, it will not be covered by your plan. This policy will not apply to members of our Medex®' and Medicare HMO Blue® plans.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.